Oct 19, 2016

CRISPR-based startups rush to IPO and don’t seem to care that we don’t know who officially owns CRISPR

Posted by Shane Hinshaw in categories: biotech/medical, genetics

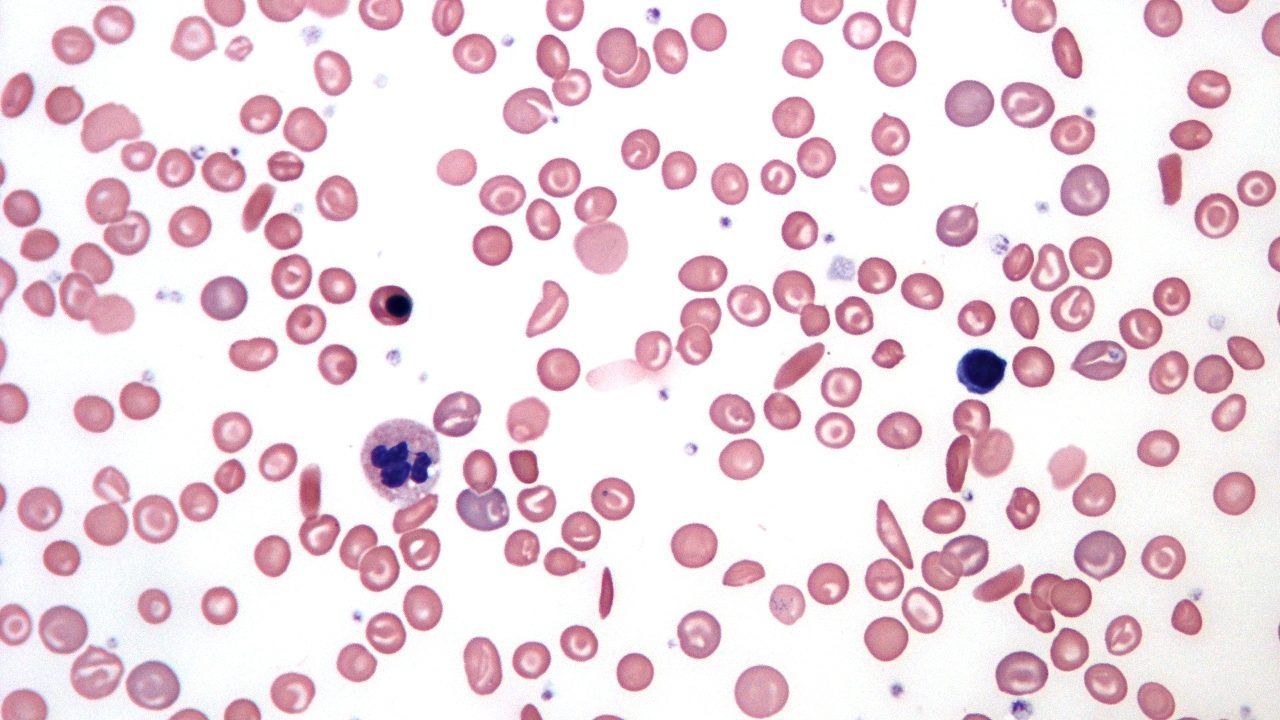

CRISPR Therapeutics—a Swiss startup hoping to harness the gene-editing technology it’s named after to develop treatments for genetic illnesses like sickle-cell anemia and cystic fibrosis— went public today (Oct. 19), raising $56 million in its initial public offering. It’s the third CRISPR-related biotech to IPO this year despite a pitched battle over who owns the patent to the breakthrough technique.

The market for CRISPR (short for “clustered regularly interspaced short palindromic sequences”) is projected to be worth more than $5.5 billion by 2021, nearly double its current value, according to research firm MarketsandMarkets. The potential of the cheap, easy-to-use technology—which could do everything from creating a mushroom that doesn’t brown to curing cancer by cutting and pasting snippets of DNA—has companies rushing to develop new applications even though no one knows who will ultimately control it.

“It’s a race,” says Fabien Palazzoli, head of biotech intellectual property (IP) analytics for the consulting firm IPStudies. “It’s a race for the IPO, for the scientific results, for the FDA recommendation, for the IP.”