As Hewlett-Packard Enterprise Co. (HPE) Discover 2016 opens tomorrow in the Venetian/Palazzo in Las Vegas, the big question hanging over it is: Quo Vadis HPE? Last month the company surprised the industry with the announcement that it would spin off its huge consulting division, the second time in a year it has split itself in half. What is left is the core hardware division of HPE stripped of almost everything extraneous. It is still one of the largest vendors in the industry, with an aging business with huge revenues but shrinking margins facing major competition from every side. It is also a company with huge potential. This conference will be the forum for HPE to unveil its plans for the future.

theCUBE will be at Discover 2016 starting tomorrow, for three days of wall-to-wall interviews with key executives from HPE, its partners and customers. Watch streaming coverage live and find out what is happening behind the headlines with the probing interviews conducted by the industry experts from SiliconANGLE Media, led by co-CEOs John Furrier and David Vellante. And if you have your own questions, you can post them on the #HPEDiscover CrowdChat that will run parallel to the conference. Furrier in particular monitors CrowdChat and will use questions people post there. If you are at the conference you can watch the replays later to pick up things you missed and get more depth on the trends.

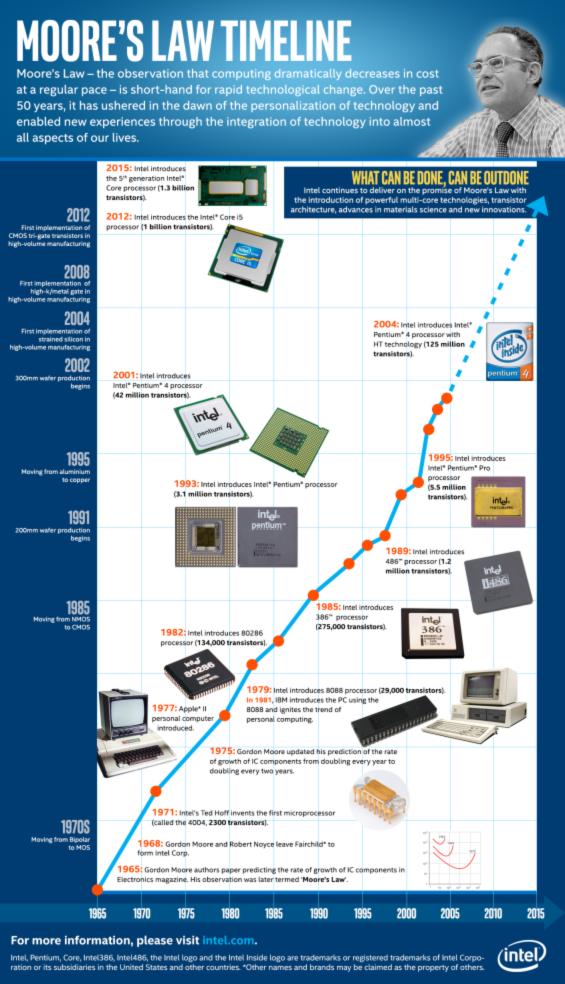

The two spin-offs have left HPE in a strong position financially. It has rid itself of nearly all its debt and is still throwing off huge amounts of cash from its hardware business. However, the IT infrastructure market is changing radically under pricing pressure from the big cloud providers with their hyperscale data centers. In the last 18 months we have seen IBM sell its entire x86-based business to Lenovo Group Ltd. and Dell Inc. announce that it will purchase EMC, both clear responses to this margin pressure. While the hardware market is growing with the new, high-volume computing environments such as social media, Intel-powered servers in particular are rapidly becoming commoditized. One way or another, HPE needs to transform. Intel Inside will not be enough to sustain it as it is today.

Continue reading “As #HPEDiscover 2016 opens, the market asks ‘quo vadis?’” »