Dec 1, 2017

Company Offers to Freeze Your Body Before Death

Posted by Brady Hartman in categories: biotech/medical, bitcoin, cryonics, cryptocurrencies, law, life extension

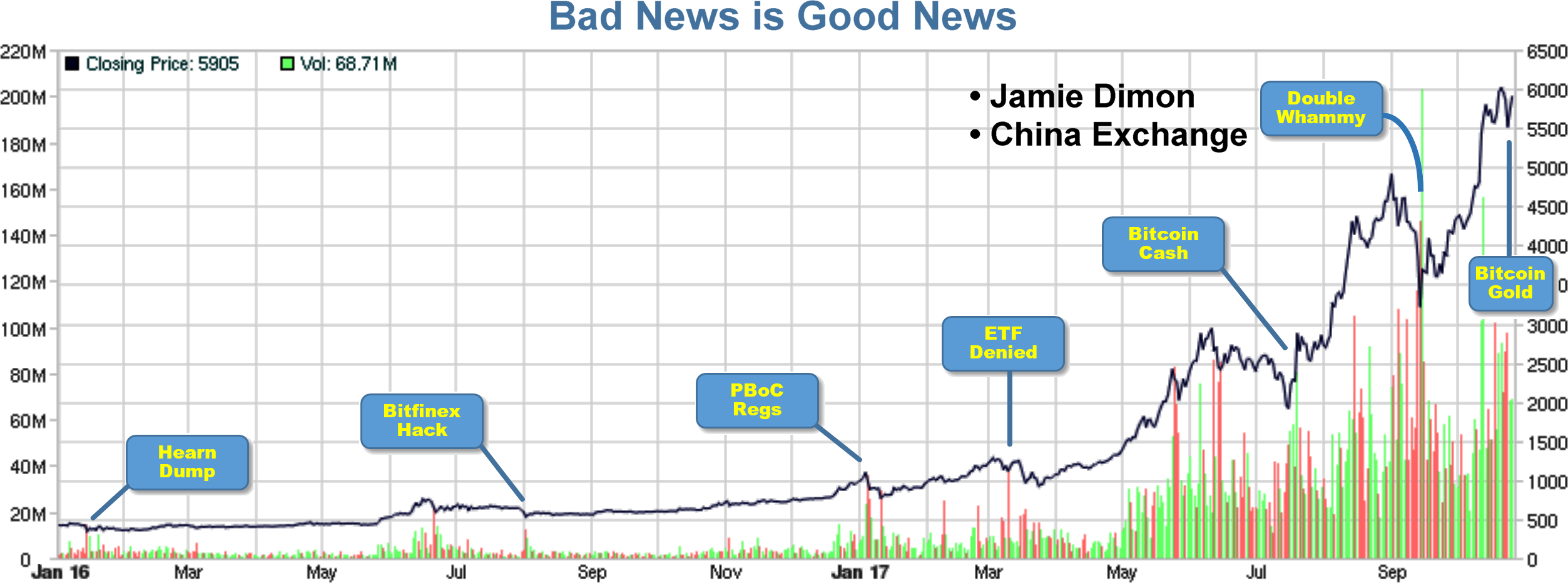

Summary: Cryonics firm CryoGen makes a radical new proposal to freeze people before death, known as ‘mercy freezing.’ Customers will pay for the Cryopreservation: Also called cryobanking. The process of cooling and storing cells, tissues, or organs at very low or freezing temperatures to save them for future use. Used in cryonics and the storage of reproductive cells in fertility treatments. [Source – NCI].” class=” glossaryLink “cryopreservation using a new blockchain based cryptocurrency called the CRYO. [This article first appeared on LongevityFacts.com. Author: Brady Hartman. Follow us on Reddit | Google+ | Facebook. ]

Cryonics is legally allowed only after death, and during this time the body starts to decay. Cryopreservation should ideally be performed within a few minutes of the patient’s demise. This happens less than half the time for current cryonics clients, and their tissues start turning to mush before freezing.

A Russian-Swiss company named CryoGen plans to solve that problem by freezing people before death, calling it ‘mercy freezing.’ CryoGen is building a cryonics lab in Switzerland, a country where euthanasia is legal. According to a white paper on CryoGen’s website.

Continue reading “Company Offers to Freeze Your Body Before Death” »