With the price of a bitcoin surging to new highs in 2017, the bullish case for investors might seem so obvious it does not need stating. Alternatively it may seem foolish to invest in a digital asset that isn’t backed by any commodity or government and whose price rise has prompted some to compare it to the tulip mania or the dot-com bubble. Neither is true; the bullish case for Bitcoin is compelling but far from obvious. There are significant risks to investing in Bitcoin, but, as I will argue, there is still an immense opportunity.

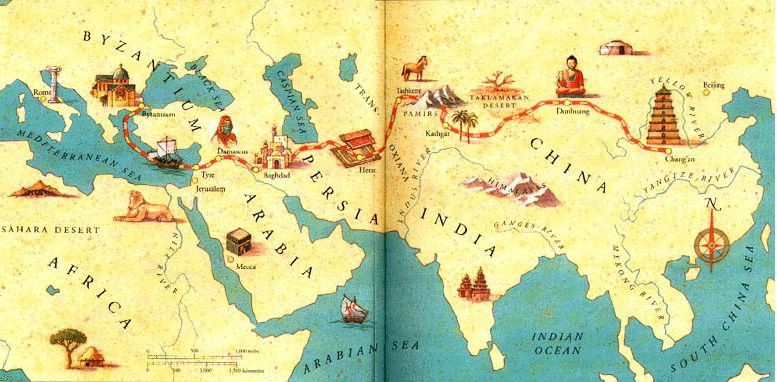

Never in the history of the world had it been possible to transfer value between distant peoples without relying on a trusted intermediary, such as a bank or government. In 2008 Satoshi Nakamoto, whose identity is still unknown, published a 9 page solution to a long-standing problem of computer science known as the Byzantine General’s Problem. Nakamoto’s solution and the system he built from it — Bitcoin — allowed, for the first time ever, value to be quickly transferred, at great distance, in a completely trustless way. The ramifications of the creation of Bitcoin are so profound for both economics and computer science that Nakamoto should rightly be the first person to qualify for both a Nobel prize in Economics and the Turing award.

For an investor the salient fact of the invention of Bitcoin is the creation of a new scarce digital good — bitcoins. Bitcoins are transferable digital tokens that are created on the Bitcoin network in a process known as “mining”. Bitcoin mining is roughly analogous to gold mining except that production follows a designed, predictable schedule. By design, only 21 million bitcoins will ever be mined and most of these already have been — approximately 16.8 million bitcoins have been mined at the time of writing. Every four years the number of bitcoins produced by mining halves and the production of new bitcoins will end completely by the year 2140.

Continue reading “The Bullish Case for Bitcoin” »